Trucking demand is “near freight recession levels,” according to Bank of America. Shippers’ outlook on rates, capacity and inventory levels are matching attitudes not seen since May and June 2020, when pandemic lockdowns sent freight volumes into a historic decline.

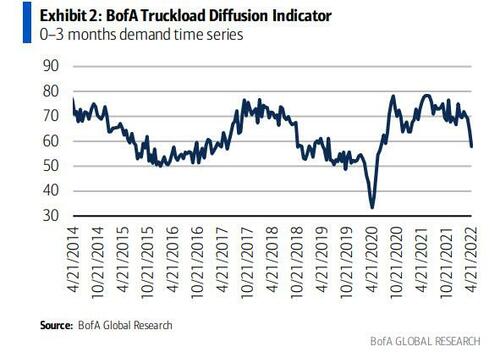

As FreightWaves reports, in a Friday note to investors, Ken Hoexter (available to Zero Hedge professional subscribers), the managing director of Bank of America’s trucking research, wrote that shippers’ view of demand is down 23% year-over-year. The proprietary Truckload Demand Indicator hit 58 — the lowest since June 2020.

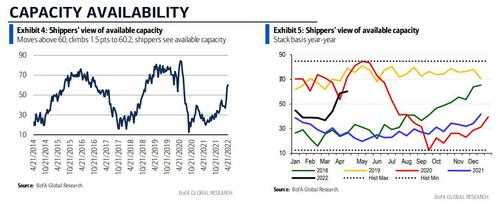

Hoexter said the shippers’ view of rates have “melt(ed) down,” hitting a low not seen since May 2020. Bank of America’s survey represented views from 44 shippers in industries including retail, consumer goods and manufacturing.

Meanwhile, these shippers are finding it easy to find capacity to move their loads; outlook on capacity hit its highest level since June 2020. They also noted their view on inventory levels had climbed to its highest point since May 2020.

A few anecdotal examples from the Bank of America survey illustrate that data. One food shipper said it was receiving more cold calls from freight brokers rather than those brokers having to seek capacity for shipments on their own. A shipper moving home-building products said flatbed capacity is loosening slightly, though is still tight. And a representative of a forest products company said rates were beginning to soften as truck capacity opened up.

Other indicators are pointing to freight recession

FreightWaves has previously reported that a “sharp, painful downturn” in the U.S. trucking market is coming. The Friday note to investors is the latest indicator of the trucking bloodbath that many in the industry are spotting.

“The way the rates are, you have to run twice as hard to make ends meet,” Dan Guzman, a San Antonio-based fleet owner, recently told FreightWaves.

One key indicator is the FreightWaves SONAR Outbound Tender Reject Index (SONAR: OTRI.USA) . At this time last year, truckers were rejecting a whopping 25.76% of loads they had previously arranged through contract. That indicated they were able to find better loads through the spot market, where shipments are available on demand.

Now that spot market rates have declined, more drivers are moving their contracted loads. As of Sunday, the rejection rate had sunk to 9.92%.

Earlier this month, the Cass Transportation Index Report said the freight market is in a slowdown, though Cass analysts said it’s too soon to declare a recession yet.

A key leading indicator

Freight is often looked at as a bellwether for the rest of the economy. If industries ranging from retail to housing to lumber are estimating that they’ll need fewer truckers, many economists see that as an omen of an economic downturn. If people aren’t buying or building as much stuff, there’s less of a need for truckers. Trucks move 72% of all freight.

One 2019 study from Convoy, a trucking brokerage firm, found that six out of 12 trucking recessions led to macroeconomic downturns. For example, the trucking industry dipped in April 2006 — more than a year before the Great Recession slammed the larger economy.

Trucking experiences recessionary periods twice as much as the rest of the economy. But for the 2 million American truck drivers who power much of this industry, the effects can be brutal.

“Like any recession, these periodic freight industry recessions cause real turmoil for the people who work in freight: Businesses go bankrupt, people lose their livelihoods, and families are disrupted,” said the Convoy report.

There is more in the full BofA report available to professional subscribers.